Instant Credit Card Approval with No Credit Check

Instant approval credit cards are designed to provide a quick response to your application, allowing you to access credit almost immediately. These cards are ideal for those who need immediate financial assistance or wish to make urgent purchases.Typically, the approval process involves minimal documentation and can often be completed online.With instant credit card approval with no credit check, you can take control of your financial journey like never before.

Benefits of instant credit card approval without a credit check

The benefits of instant credit card approval without a credit check go far beyond convenience. Using a no credit check credit card allows you to make important purchases, handle unexpected expenses, and even build or rebuild your credit history. Additionally, these cards can help you rebuild your credit score by providing you with the chance to manage a credit line responsibly. Using these cards wisely can improve your credit score over time, opening doors to more beneficial credit products in the future.

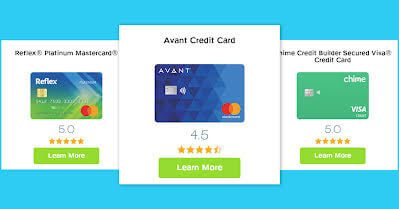

Choosing the Ideal No Credit Check Instant Approval Credit Card

When looking for a credit card that doesn’t require a credit check, it’s important to consider a few crucial factors, such as: 1.Security deposit requirements: How much does the issuer require you to deposit to open an account? Can you fund that required deposit? 2.Annual fee: Some credit cards with no credit check charge an annual fee while others don’t. Are you willing to pay a yearly fee? 3.Income requirements: Within the fine print, some credit card companies require you to meet certain income requirements. Check to make sure you meet these requirements before applying. 4.ID requirements: You’ll need to verify your identity, likely with a social security number (SSN) or individual taxpayer identification number (ITIN). 5.Age requirements: You can’t apply for your own credit card before the age of 18. If you’re under 18, you’ll need to get added as an authorized user to an adult’s account. 6.Credit score: You won’t need to meet a minimum score requirement for a no-credit-check card, but it’s still a good idea to check your credit score. You may even discover your score is high enough to qualify for a better card!

How to Apply for Instant Approval Credit Cards

To apply for credit cards with instant approval, follow these streamlined steps: 1. Research: Identify which card suits your financial situation and needs. 2. Pre-Qualification: Many card issuers offer a pre-qualification tool on their websites. This allows you to check your eligibility without affecting your credit score. 3. Complete the Application: Fill out the application form with accurate personal and financial information. Information typically includes your Social Security Number, income, and employment status. 4. Submit the Application: After confirming all information is correct, submit your application. If approved, you may receive your card in the mail within a few days. 5. Activate Your Card: Once you receive your card, activate it immediately to start using your credit line.

Conclusion

Choosing an instant approval credit card with no credit check offers a convenient, stress-free way to maintain financial flexibility. The key is to consider and understand all relevant factors thoroughly. By choosing the right card type and being fully prepared for the application process, you can find the right credit card for your needs and manage your credit effectively. Start taking control of your financial journey now!